Quadrant Investments’ annual review of its portfolio and performance for the 2023 financial year is now available. Some key highlights for us in the 2023 Financial Year included; 2 new trusts established, over 30% increase in value of assets under management, 23% valuation uplift across the portfolio since acquisition, 31%…

QUADRANT INVESTMENTS STAFF & COMPANY UPDATES

We are thrilled to share some exciting news regarding staff updates at Quadrant Investments that reflect our commitment to growth and service quality to our valued investor partners. We are proud to announce the promotion of Andrew Tyack to the position of Acquisition & Investment Manager at Quadrant Investments.

QUADRANT INVESTMENTS ACQUIRES VALUE-ADD OFFICE BUILDING

Perth-based property funds manager Quadrant Investments acquired its twelfth asset since launching, after concluding the settlement of 110 Erindale Road, Balcatta for its QI Value Add Income Trust No 3. The newly-established Trust, which is the third in Quadrant Investments’…

QUADRANT INVESTMENTS MAKES VALUE-ADD INDUSTRIAL PLAY

Property fund manager acquires industrial asset in prime northern Perth industrial locality. Perth-based property funds manager Quadrant Investments has acquired its tenth asset since launching, after concluding the capital raise fully subscribed in October for its QI...

NEW VALUE ADD INDUSTRIAL FUND LAUNCHED

We are pleased to invite you to invest into our newly established fund, the QI Value Add Income Trust No 2. The fund is being established to acquire two adjoining industrial assets in the northern Perth industrial precinct, combining for…

DIVERSIFIED FUND SETTLES NEW ASSET

We are delighted to announce that our established multi-property fund has settled on its fourth acquisition, a multi-tenanted industrial building in the core northern Perth industrial locality of Wangara.

2021 YEAR IN REVIEW- INVESTOR UPDATE

As the curtains draw to a close on another successful year for the Quadrant team and our investors, it seems an appropriate time to reflect on the playbook that was 2021. Globally and domestically, it was thought…

DIVERSIFIED FUND REOPENS FOR INVESTMENT

Quadrant Investments is inviting investment into the established multi-property QI Diversified Income Trust No 1 which has re-opened for its third-round of equity raising.

DIVERSIFIED FUND NO 1 SETTLES NEW ASSETS

We would like to advise that the second round of equity raising for the QI Diversified Income Trust No 1 closed oversubscribed and we have now finalised settlement of the fund’s latest assets.

QI DIVERSIFIED INCOME TRUST NO 1 ADDS INDUSTRIAL ASSETS TO FUND

Perth-based property funds management company, Quadrant Investments, has successfully added a large industrial complex to its diversified property fund, the QI Diversified Income Trust No 1, after closing its second round of equity raising oversubscribed in early October.

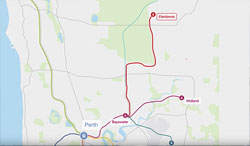

DESIGNS FOR NEW MALAGA METRONET STATION RELEASED

Photos have been released of the new designs for Malaga Metronet Station. Located down the road from Malaga Home Centre, the new station is set within an urban landscape to create a warm, safe and welcoming environment.

DIVERSIFIED FUND FORECAST TO DELIVER STRONG MONTHLY INCOME RETURNS WITH LATEST INDUSTRIAL ACQUISITION

Perth-based property funds management company, Quadrant Investments, is inviting investment to wholesale and sophisticated investors in the established QI Diversified Income Trust No 1, which is forecast to deliver monthly distributions of 7.0% p.a. this financial year.

QUADRANT INVESTMENTS ESTABLISHES NEW TRUST WITH ACQUISITION OF MIDLAND CBD PROPERTY

After closing its first round of equity raising oversubscribed late last month, Perth-based property funds management company, Quadrant Investments, has established its new QI Diversified Income Trust No 1, facilitating the acquisition of a prominent two-level office building in the core of the Midland CBD later this month.

QUADRANT INVESTMENTS LAUNCHES NEW TRUST

Quadrant Investments invites applications to invest in a new wholesale unit trust targeting quality assets across a range of sectors in prime locations. Through strategic analysis and selection, the Trust aims to provide investors with stable income return and capital growth over the life of the Trust.

2020 YEAR IN REVIEW – INVESTOR UPDATE

Despite the back-drop of COVID-19, remarkably, the Quadrant Investments’ (QI) business and our Trusts experienced a number of significant achievements and highlights in 2020. We’d like to share a handful with you further below.

QUADRANT INVESTMENTS PARTNERS WITH ONE OF AUSTRALIA’S OLDEST PRIVATE COMPANIES

One of Australia’s oldest private companies, Richard Noble & Company, has expanded their property service offerings, purchasing a 50 percent stake in established property fund manager Quadrant Investments. The strategic investment and partnership was identified by Richard Noble & Company’s managing director, Alex Gregg, as an opportunity to deliver significant growth from the Quadrant Investments business, leveraging Richard Noble & Company’s 107 year track record and success in the property sector.

MORLEY-ELLENBROOK ROUTE CONFIRMED

A positive announcement for Quadrant Investments – Malaga Home Centre within its Large Format Retail Trust No 1 portfolio. We are pleased to see the WA State Government’s recent announcement confirming the route alignment for the Morley-Ellenbrook Train Line. Glad to...

UNLISTED PROPERTY FUNDS OUTPERFORM IN 2018

The AFR recently published an article highlighting the out-performance of the unlisted property fund sector. While we acknowledge that we are somewhat biased on this topic, the AFR article with research from the Property Council of Australia highlights that the...

QUADRANT LANDS IN JOONDALUP WITH CBD BUY

As reported in the WA Business News on Wednesday 11th of December 2019, Quadrant Investments has successfully completed settlement of our latest asset. Our newly established QI Value Add Income Trust No 1 will commence with 8.0% p.a. monthly distributions to investors...